July 10, 2023 • White Paper

The Independent Broker Model (IBM): A Joint-Venture Alternative

How the 2023 Mortgage Brokerage Model Outperforms the Legacy Mortgage JV for a Real Estate Brokerage Company

1. Executive Summary

The focus of this white paper is to highlight the opportunities for real estate brokerages to stand up a mortgage brokerage business to serve its real estate professionals and clients. This paper outlines the unique advantages of the mortgage brokerage model versus the legacy joint venture model. The income streams are significant for real estate brokerages of scale.

Establishing a mortgage joint venture operation can be complex, expensive and risky. A mortgage brokerage business, when effectively managed with a competent partner, can become the most profitable source of ancillary income in the industry. The key to a successful partnership lies in addressing three fundamental issues, which equates to the right mix of Price-Product-Service:

Light Start-up Costs & Ongoing Management Oversight

Broad Mortgage Product Offerings and Competitive Pricing

Compliance Guidelines

About Realfinity:

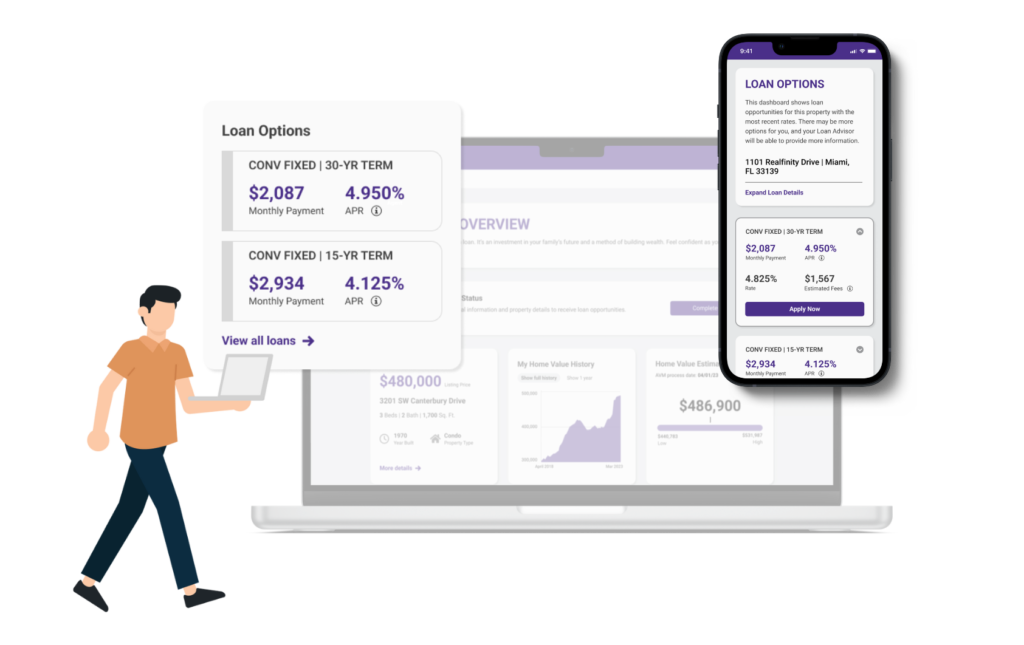

Realfinity.io is a cutting-edge technology company that has pioneered a digital platform known as HomeDashboard. This unique web application delivers property data and finance options to homeowners and homebuyers, all at their convenience. It also offers integration with mortgage brokers’ pricing engines and point-of-sale systems, creating a streamlined and comprehensive process. Additionally, HomeDashboard functions as a reliable record-keeping and data management platform for mortgage brokers delivering next-gen data management. In other words, HomeDashboard allows you manage your “homeowners and homebuyers under management,” a core metric that will have big influence on your enterprise value.

In addition to its software, Realfinity provides professional services to its clients and operates/services multiple mortgage brokerage entities under its Independent Broker Model (IBM), including its wholly owned subsidiary, Real-Finity Mortgage, LLC (NMLS #2445766).

2. Direct-to-Consumer Financial Services in Residential Real Estate

In the ever-changing landscape of residential real estate, the industry is witnessing a notable trend toward direct-to-consumer marketing (D2C). This D2C momentum is completely bypassing the conventional path of accessing consumers through real estate brokerage companies and their real estate professionals.

Real estate brokerage companies of scale in excess of 2,000 closings a year have an exceptional opportunity to embrace ancillary services such as title, escrow and mortgage-related revenue streams increasingly relevant. Among these, the most lucrative affiliated service is a mortgage operation.

Attach rates, which measure the success of partnerships in retaining business, tend to be highest for collaborations between homebuilders and lenders, reaching up to 60%. Partnerships between real estate brokerages and lenders, on the other hand, typically yield lower capture rates ranging from 18% to 25%.

3. The Status Quo for Real Estate Brokerages

Mortgage Joint Ventures (JVs) are currently the most discussed framework for real estate brokerages looking to expand into mortgage operations. However, they are often seen as high-risk, capital-heavy, time-consuming, and difficult to manage.

A new value proposition has emerged that offers real estate brokerages complete control over the entire mortgage entity while retaining all equity value – the Independent Broker Model (IBM). This route is a true game-changer, emphasizing the significance of the real estate broker and, for the first time, allowing real estate brokers to realize the full enterprise value of a vertically integrated and self-reliant real estate enterprise.

The rise and success of wholesale lenders has paved the way for alternative structures that are less dependent on extensive balance sheets to incorporate mortgage as a ancillary service and revenue generator. The two largest nationwide wholesale mortgage lenders are 30 times larger than the biggest JV lenders!

4. The Traditional Lender JV Model

a. Structure and Setup

A conventional JV is legally structured such that the lender partner holds the majority stake due to licensing prerequisites. This arrangement effectively leaves the real estate company with less than half of the equity in the joint venture. This also creates an imbalance of voting rights in favor of the lender partner.

The JV entity must obtain licenses from the respective regulatory body in each state as well as Federal (FHA/VA/HUD) it plans to operate and lend in. This necessitates a significant amount of administrative work for a specific entity where the real estate broker typically owns less than half of the mortgage enterprise.

Due to the minority ownership, there are no real liquidating events around JVs. Investors typically don’t want to buy an entity that is highly dependent on a third party, like the lender partner, who already owns the majority of equity in the partnership.

The initial setup usually necessitates an investment of $1 – $1.5 MM for each equity partner, which is crucial to meet net worth requirements imposed by warehouse lenders and investors who buy the originated loans.

b. Operation

JVs are customarily lenders, not mortgage brokers, meaning they originate, process, and ultimately underwrite loans in-house. Loans are then funded through available warehouse lines of credit and kept on the balance sheet until sold to the investor.

While a lender setup allows for control over loan processes, the risk exposure is significant, leading to the failure of many JVs in recent years. Mortgage lending is a highly cyclical business, sensitive to interest rates, requiring agile and vigilant management. Many JVs have collapsed in the past due to the inability to swiftly adjust the large staff necessary for loan processing, underwriting, funding, and ultimately selling to capital markets, as market conditions change. The ancillary nature of this business, not being the main focus, has historically led to many real estate brokerages with JVs failing to adapt their workforce promptly.

The lender partner typically selects the technology stack based on the systems they use in their primary operation. Given that these lenders are typically not tech companies, their technology choices can be biased and outdated, posing an additional potential challenge for real estate brokerages heavily reliant on their lender partner.

A JV is inherently a captive partnership, as the real estate brokerage partners with one lender who owns the majority of the JV entity. This often leads to situations where product and competitive pricing objectives are unmet due to conflicts of interest between the real estate brokerage and lender partner.

5. The Independent Broker Model (IBM)

The IBM represents a unique approach that deploys independent mortgage brokerage entities, enabling real estate brokerages to incorporate mortgage as an ancillary service and source of revenue. IBMs, set up and initially managed by Realfinity, provide an exceptionally profitable and balance-sheet-light method for real estate brokerages to penetrate the mortgage sector.

a. Structure and Setup

The IBM setup begins with Realfinity, which registers and licenses an LLC on behalf of the real estate brokerage. The real estate brokerage holds 100% equity ownership in this entity, effectively positioning Realfinity as a service provider. The IBM model aims to establish a fully autonomous and independent entity that allows the real estate broker to realize equity value based on a revenue/EBITDA multiple in case of a liquidating event.

Depending on the state, the initial investment (state licensing & initial software) for a mortgage brokerage under the IBM model can be up to $75k.

The mortgage brokerage entity has wholesale lender contracts with a vast selection of chosen wholesale lenders effectively making it an independent operation. The end borrower/consumer wins because in the end the real estate brokerage simply offers a marketplace where Price-Product-Service wins the loan transaction from the Independent Broker Model.

b. Operation

Mortgage brokerages powered by the Realfinity IBM model are supported by a technology stack that includes Realfinity’s HomeDashboard as the data management and client-facing platform, complemented by LenderPrice as the pricing engine partner and LendingPad as the backend loan origination system (LOS). The software stack is fully web-based, which means even less start-up costs and infrastructure cost.

Instead of binding the real estate brokerage to one lender, the IBM model leverages multiple wholesale lender partners. This leads to a more streamlined operation that delivers price, product and service. The IBMs role focuses only on loan origination, processing, and submission of a complete loan file to a corresponding wholesale lender. Advancements in technology and highly efficient wholesale lender operations have ensured that underwriting, funding, and secondary market sales are all managed by the wholesale lender. This setup does not impact the customer experience, and the real estate broker retains complete control over the mortgage.

As an IBM, the real estate company has the option to offer equity to realtors who invest in the service while retaining voting control. This caveat creates brand loyalty by the strongest producing realtors feeling that they have a voice and upside from having equity in the IBM.

6. The Economics of a Mortgage Operation

A Mortgage Joint Venture (JV) operation primarily depends on gain-on-sale margins as its main revenue stream, which arises from the sale of a particular mortgage into secondary markets. Large lenders can achieve better outcomes due to economies of scale, significantly affecting gain-on-sale margins.

On the other hand, an Independent Broker Model (IBM) based mortgage operation relies on commissions paid by various wholesale lenders upon submission and funding of a mortgage file. The wholesale lenders essentially pass on their pricing power back to the IBM thus giving major pricing advantage over the JV model. It allows the mortgage broker to have full control over the margin incorporated into the mortgage products offered to clients. The system is self-regulating, as wholesale lender partners continuously compete, automatically eliminating uncompetitive market participants.

Summary — a side by side comparison:

| Option | Independent Broker Model | Joint Venture |

| Equity ownership | 100% | 49.1% real estate company |

| Capital required | ~$75,000 | ~$1,500,000 |

| Management | 100% | 49.1% |

| Voting Rights | 100% | 49.1% |

| Balance sheet risk – loan repurchase | 0% | 100% |

| Time to market | 60-90 days | 6-9 months (audit & investor approvals) |

| Ownership of data | 100% | 49.1% |

| Enterprise Value | 100% | 49.1% |

| Determine MLO Commission | 100% | 49.1% |

| Time to exit | 30 days | 6 months |

| Startup cost | $75,000 | Overall $3,000,000 |

| Return on Investment (ROI) | Based on $75,000 risk | Based on $1,500,000 risk |

Unrealized financial consequences of a JV-based mortgage operation occur when the buyer (end investor) of a mortgage finds a defect in the underwriting process of the JV. In this case the end investor requires the JV to re-purchase the loan and accept the interest rate and credit risk of the damaged loan. It also carries substantial risks as loans are temporarily held on the balance sheet. This dynamic has led to lenders facing considerable margin calls when their investors pull back from purchasing mortgages, leaving them on their balance sheet.

An IBM-based mortgage operation prioritizes a consistent, risk-free commission-based revenue stream, making it similar to consistently hitting singles and doubles versus aiming for home runs. Why? Because the wholesale lender takes on all underwriting risk of each loan thus saving the IBM from having a balance sheet issue pertaining to defected loans.