Solutions

How it works

Company

© 2025 Real-Finity, Inc.

Cheers from Miami 😎

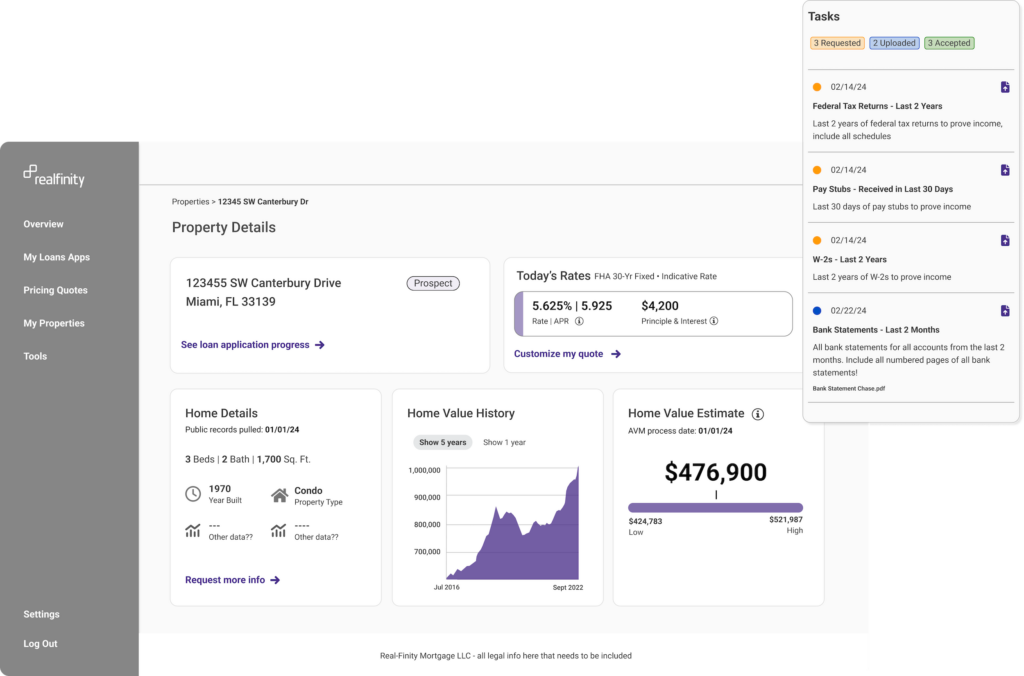

Mortgage broker and loan processing services are offered through Real-Finity Mortgage, LLC, dba Realfinity. NMLS #2445766. Real-Finity Mortgage, LLC is a licensed mortgage brokerage and maintains its corporate headquarters at 929 Alton Road Suite 500, Miami Beach, FL, 33139.