Unlock new opportunities with dual-licensing

Provide a seamless, end-to-end real estate experience for your client

Earn more money on each transaction from helping clients with their mortgage

Gain control of your transaction since you own the whole home-buying process.

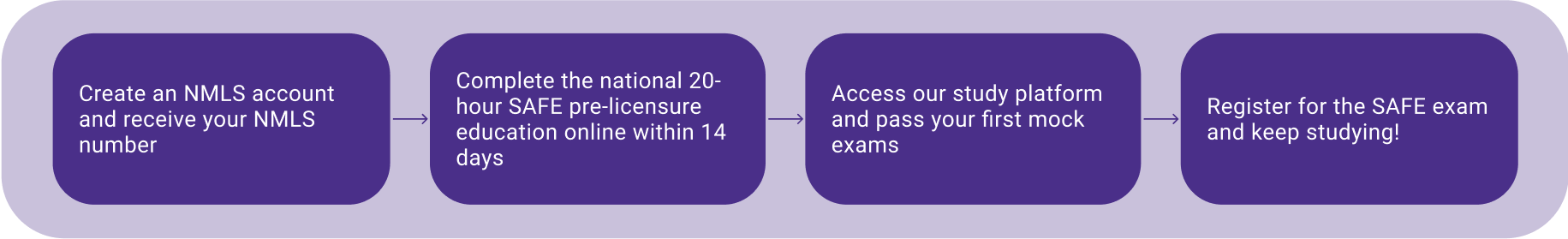

Your licensing journey

Start

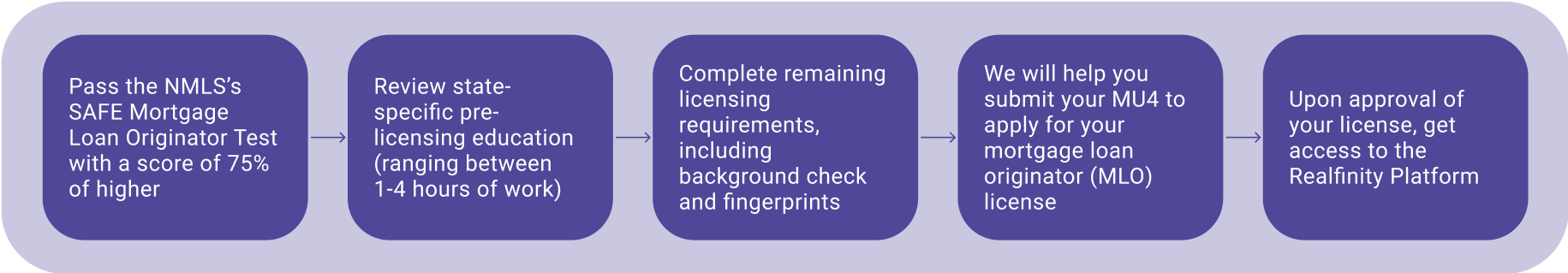

Get Licensed

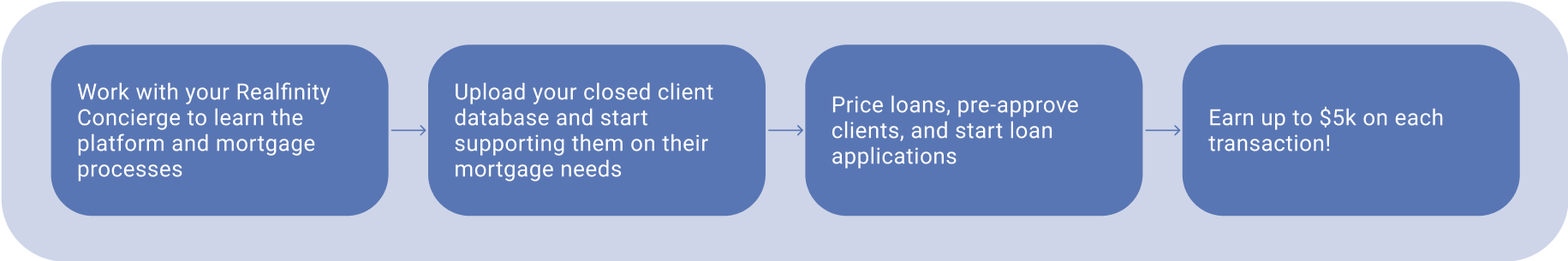

Build Your Business

Start offering mortgage services while leveraging the full power of our tech and team.

Why Realfinity?

A partner enhancing every part of your mortgage services

Highest Commissions

Enhance your client-experience, while capitalizing on both past and future clients – a unique advantage only our platform offers.

Professional Presence

You are positioned as the only advisor on each transaction, ensuring a fully digital mortgage service under your trusted brand.

Simplified Operations

We process your loans, so you can focus on serving your clients. You will never feel like you are doing two jobs at once.

Best Product & Price

Compare rates from many different investors on our platform to find the best deals for your clients.

Become dual-licensed with Realfinity and make an extra commission on each transaction.

We want you to succeed, and we’re here to help!

Realfinity’s support team is available 24/7 to help answer your questions.

FAQ

Once you pass your SAFE exam, Realfinity Mortgage will provide you with its standard Mortgage Loan Originator (MLO) agreement. This contract outlines key details such as commission structure, responsibilities, tasks, and includes a Non-Disclosure Agreement (NDA).

Realfinity Mortgage, acts as the lender and earns a fee each time a loan is funded, which is paid by the borrower as part of the loan process.

No, there are absolutely no hidden costs for dual-licensed agents on the Realfinity platform.

Realfinity does not deduct any fees from your commission. However, you will be responsible for filing and paying applicable taxes and social contributions on the commission earned.

Yes, you will be employed as a W2 outside sales employee by Realfinity Mortgage. This is required to sponsor your Mortgage Loan Originator (MLO) license and to process your commissions.

No, real estate agents have long been allowed to hold dual roles on conventional loans, and under HUD’s Mortgagee Letter 2022-22, they are also allowed to serve in dual roles on most government-backed loans. This means you can hold both licenses and remain employed by your real estate brokerage as well as Realfinity Mortgage.

As a dual-licensed agent with Realfinity, you can earn up to 1.4% of the loan amount, with a maximum commission of $5,000 per transaction.

Realfinity Mortgage is a licensed entity that holds lending licenses in various states. Realfinity, Inc. is the parent company responsible for developing the proprietary platform that supports dual-licensed agents.

You will be paired with an experienced Realfinity Concierge, who is a licensed loan officer. They will guide you through the onboarding process and assist you during your first transactions. Any questions you have can be promptly addressed by your Concierge, who is always available via call or message. Additionally, Realfinity offers a comprehensive library of knowledge base articles and video training on the platform, which you will unlock access to during onboarding.