January 17, 2024 • White Paper

The Ultimate Real Estate Agent Career Move

Becoming Dual-Licensed to Offer Mortgage Services

2023 marked a pivotal year in the residential real estate sector, primarily due to significant shifts in transaction processes and the evolving role of buyer agents. This whitepaper explores the implications of dual-licensing for real estate agents, a pivotal opportunity that Realfinity believes is critical amidst changing dynamics.

Background & Regulatory Environment

A series of class-action lawsuits challenging the commission structure of buy-side real estate agents catalyzed a reevaluation of their value proposition. A closer look shows that regulators and government supported organizations are laying the groundwork for real estate agents to continue to expand their service to homeowners and homebuyers. The practice of dual licensing is now permissible in 45 states, signaling a paradigm shift in the industry.

The most impactful decision by a regulator has been a letter issued by the Department of Housing and Urban Development (HUD) specifying the criteria for when an individual may hold several roles or receive different types of compensation in a single FHA transaction. This alteration in regulations will enable individuals to perform as both the real estate agent and the mortgage originator in the sale of homes insured by the FHA. In order to earn a fee for the roles of a real estate agent and a mortgage loan originator, an individual must perform both roles. On the mortgage loan originator side this would include taking an application and being otherwise available to assist with the origination of the buyer/borrower’s loan application. It is important to let consumers know they don’t have to use the mortgage services of a dual-licensed agent and can freely choose any lender or broker they prefer.

Before, engaging in such practices was not allowed with FHA loans, though it was permissible with non-FHA financing. The modifications mentioned in the HUD’s Mortgagee Letter 2022-22 might not greatly affect the average loan originator, yet they establish a foundation for enabling dual-capacity roles in home purchase transactions.

In the subsequent parts of this white paper, we aim to thoroughly analyze the potential operational and economic benefits that can emerge for both real estate agents and homeowners/homebuyers by fundamentally reevaluating the traditional value chain in residential real estate transactions. We will also elaborate on why we strongly believe that existing traditional retail lenders or mortgage brokers are not well positioned to drive this change due to conflicts of interest and internal cannibalizing effects when embracing the rethinking of the traditional value chain to drive operational and economic opportunities.

The Problem

The current landscape of retail Mortgage Loan Officers (MLOs) and traditional brick-and-mortar lending institutions has led to a trust deficit among homeowners and homebuyers. An in-depth analysis by Housingwire highlighted predatory commission structures in traditional retail lending that have become the norm. Real estate agents often find themselves safeguarding their clients’ interests against misaligned incentives from retail lenders and mortgage brokers grappling with reduced financing volumes and commission-driven motives.

The current market conditions have opened a unique opportunity for real estate agents to evolve into comprehensive real estate advisors, extending their expertise to include mortgage financing. With this expansion of services, agents can more effectively align with their clients’ interests. Utilizing a financial service enabler like Realfinity, they are well positioned to represent their clients’ best interests in a more holistic manner while not shifting their focus away from their competency of selling homes.

The Solution

According to the National Association of Realtors, 89% of homebuyers in 2023 employed the services of a real estate agent when purchasing a home. This shows the continuously strong positioning of the real estate agent as an advisor in the residential real estate transaction.

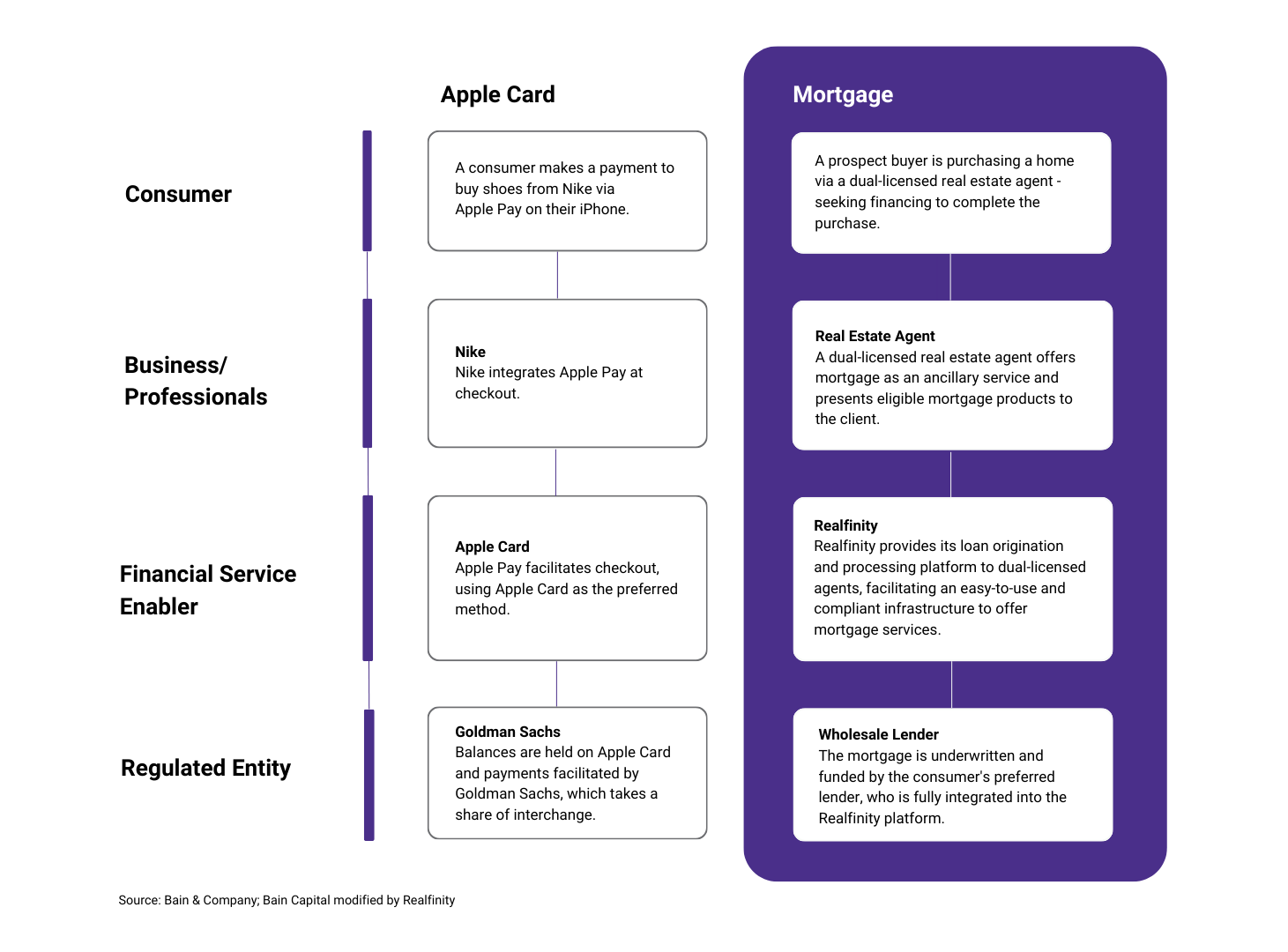

Realfinity’s Dual-License Program presents a transformative solution to the current market environment and general consumer trends. It fundamentally redefines how mortgages are being offered, sold, and distributed to borrowers. However, this paradigm shift requires a robust platform enabling agents to offer mortgage products seamlessly throughout the real estate lifecycle without the burden of managing dual roles, compliance and technology hurdles.

The transformation and distribution of mortgages through new channels provides borrowers with a ‘marketplace’ experience, resulting in more aligned interests and improved mortgage rates. To ensure its effectiveness, it is crucial that the financial services enabler maintains a degree of independence from the regulated entity, known as the creditor.

Figure 1: Mortgages through new channels provides borrowers with a ‘marketplace’ experience, resulting in more aligned interests and improved mortgage rates.

Three Key Components of the Solution

- Compliant Origination Platform: A platform that allows real estate agents to offer mortgages as an ancillary service, eliminating industry compliance and technology burdens.

Marketplace Experience: Ensuring consumers have access to multiple competing wholesale lenders, promoting consumer choice for enhanced trust and an empowered client-agent relationship.

Loan Processing: A processing service partner that manages all documentation requirements once the loan application is taken, preventing agents from having to manage multiple roles at once.

Benefits of Becoming Dual-Licensed

One-Stop Shop Advantage

A platform that allows real estate agents to offer mortgages as an ancillary service, eliminating industry compliance and technology burdens.

Increased Revenue Streams

The integration of mortgage services offers income diversification, allowing agents to earn from both home purchases and mortgage transactions.

Enhanced Financial Benefits for Clients

By removing additional costs associated with customer acquisition typically borne by lenders competing for real estate agents or client business, dual-licensed agents can reduce the expenses involved in originating loans. This efficiency enables them to provide more competitive, lower mortgage rates to their clients.

Enhanced Client Loyalty

The ability to offer value via refinances or cash-out opportunities outside of a sale or purchase transaction increases the client touchpoints and thus builds stronger, lasting client relationships.

Increased Transaction Control

Offering mortgage services streamlines the process and enhances transaction efficiency, giving buyer agents greater control over the transaction.

Personal Development

Enhancing your expertise in real estate to provide superior service to clients, while embracing new challenges that solidify your standing in a competitive market as a real estate agent.

Conclusion

This whitepaper is dedicated to exploring the transformative impact of dual-licensing within the real estate sector, with a focus on Realfinity’s role as a financial service enabler through its innovative loan origination and processing platform. It further elaborates on the benefits of the Dual-License Program, particularly in terms of cost-effectiveness. By eliminating additional customer acquisition cost, dual-licensing facilitates more favorable mortgage rates for clients. Additionally, it offers a comprehensive, end-to-end transaction experience.

This innovative approach is not merely a change but a leap towards redefining the US residential housing market and the way mortgages are being offered, sold, and distributed. It promises a future where real estate transactions are transparent, agents are empowered, and clients are at the center of a more informed and trustworthy ecosystem. As we look ahead, Realfinity’s role in this paradigm shift is not just about offering new services but about championing a movement towards a more equitable and efficient real estate landscape.