August 31, 2023 • White Paper

Embedded Finance: Unleashing the power of vertical integration and mortgage as an ancillary service

Placeholder subheader (hidden)

Vertical integration and incorporating mortgages as an ancillary service are not new ideas in the world of residential real estate. There is a consensus that these strategies are essential for providing a comprehensive, one-stop-shop consumer experience. However, opinions differ on the optimal structure and the size at which it becomes logical for businesses with a captive audience—such as real estate brokerages, homebuilders, or wealth advisors—to venture into the mortgage sector.

What are the dominant options today:

Traditionally, collaborations in this sector have largely adopted the Joint Venture (JV) model. As Mark McLaughlin, Chief Strategist at Compass and board member at Realfinity, points out, a JV becomes truly efficient, from both administrative and operational perspectives, when it involves around 2,000 buy-side transactions yearly. This figure is based on an expected 25% success rate in turning buy-side transactions into closed loans, translating to an entry threshold of 500 finalized loans each year.

Prominent national mortgage banks, such as Guaranteed Rate, NewRez, and New American Funding, have been strategically expanding their market presence, with each JV they establish. However, such national-level JVs encounter obstacles. Specifically, local real estate agents tend to value their connections with their local teams or divisions more than with these large corporate brands, leading to reduced commitment rates. Furthermore, while JVs present lucrative loan opportunities for major lenders, they require a substantial investment and can deviate from the primary focus of other businesses. The instability of markets, fluctuating manpower needs, and limited economies of scale further compound these challenges, often causing JVs to fail.

Smaller entities like real estate brokerages, homebuilders, or wealth advisors, which can’t hit the 500 closed loan benchmark, are left with the Marketing Services Agreement (MSA) as their sole option. MSAs come with inherent risks because the anticipated benefits from the marketing activities don’t always match the actual services rendered. This discrepancy can lead businesses into arrangements where lenders overcompensate for services that are either undervalued or not delivered, introducing potential compliance hazards and other risks.

Future shaping alternatives:

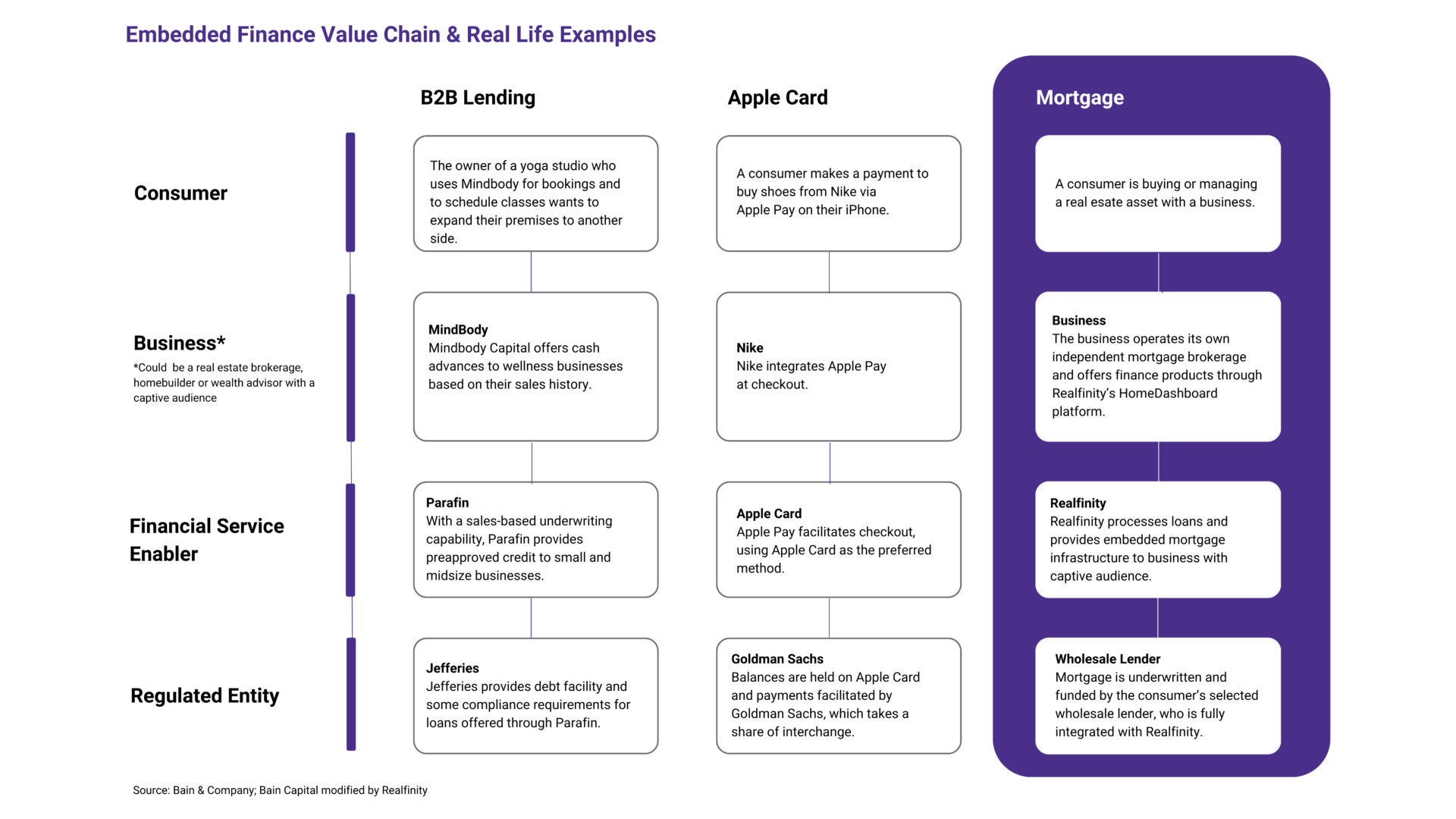

The concept of embedded finance is defined as a business providing an adjacent financial service for which it takes some degree of economic ownership. This allows the businesses’ consumers to take advantage of a value-added offering within the native consumer journey. The adjacent service must have a financial core, such as banking, payments, lending, or insurance.

Figure 1: Different examples of embedded finance use cases.

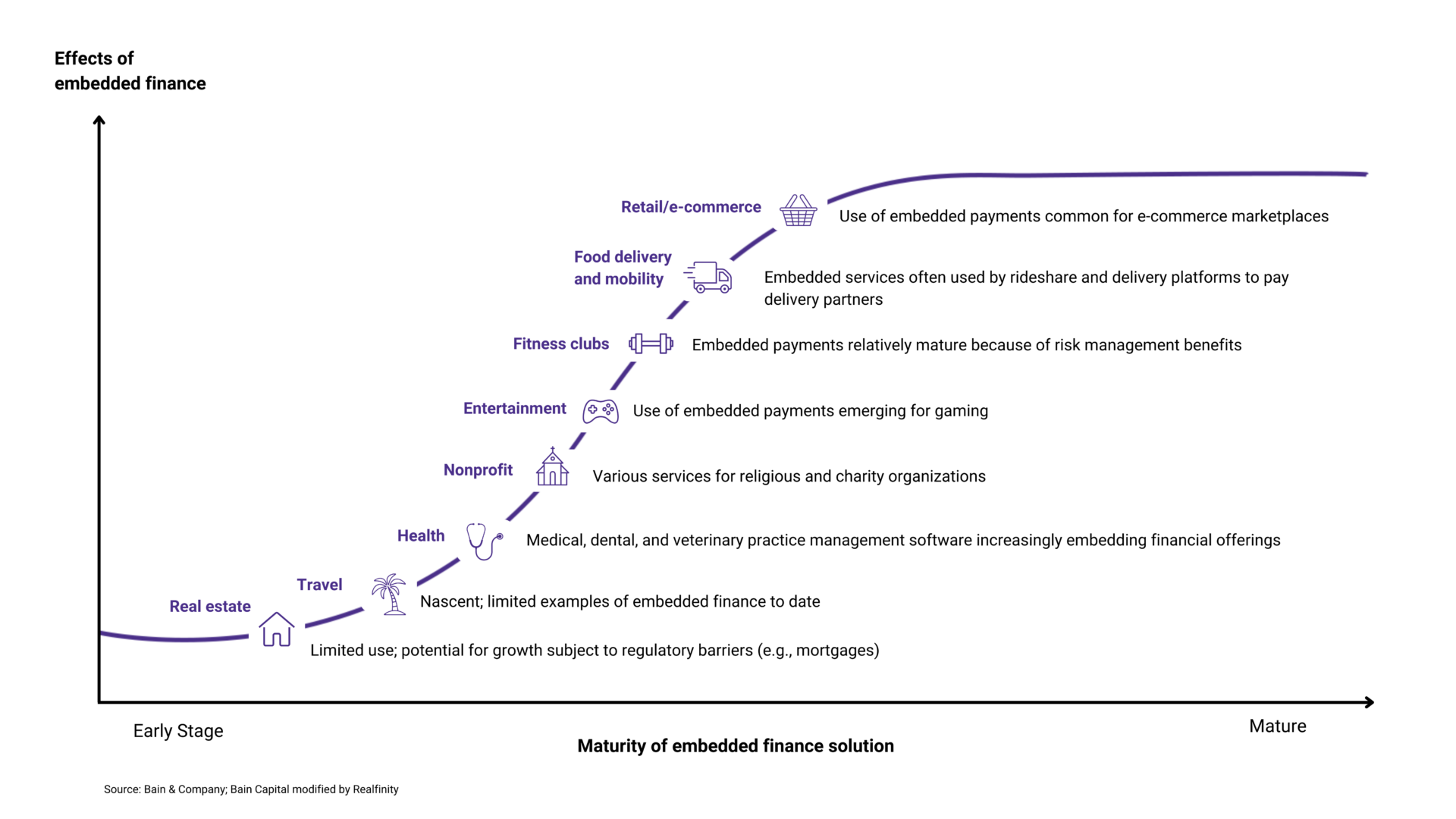

Figure 2: Different industries show varying levels of maturity in embedded finance (real estate being the least advanced).

Figure 2 above illustrates the varying levels of maturity in embedded finance across different industries, with real estate being the least advanced. Realfinity realizes this potential for growth and is pioneering this trend in the real estate sector—a historically slow adopter and underdeveloped industry—poised for transformation like other sectors.

Realfinity’s Independent Broker Model (IBM) is an embedded finance solution, as shown in Figure 1, that empowers businesses with a captive audience to provide a seamless, value-adding experience to their consumers, thereby enhancing engagement, retention, and lifetime value (LTV).

Differentiating factors:

Realfinity’s embedded finance model differs from the models described above in two fundamental ways, making it more flexible, profitable, and compliant than existing options.

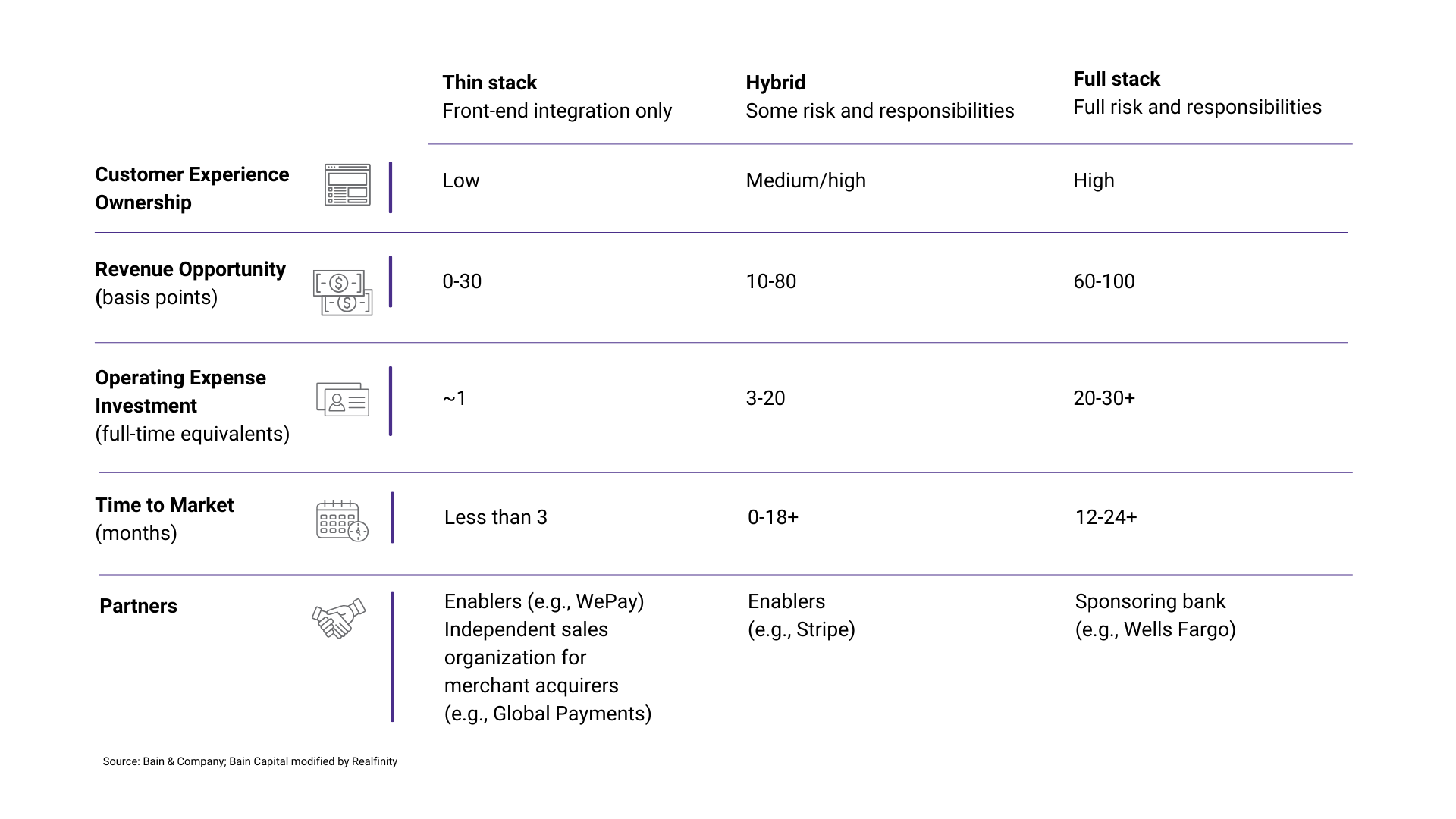

Realfinity’s IBM modularizes the entire mortgage process. A business with a captive audience, such as a real estate brokerage, homebuilder, or wealth advisor, establishes its own wholly-owned Independent Mortgage Brokerage with the help of Realfinity’s licensing team. The sole responsibilities retained by the Independent Mortgage Brokerage are advisory and sales, while Realfinity manages all other aspects of the infrastructure. To contextualize, embedded finance offerings can vary from a deep reliance on enabling partners to be predominantly in-house. Realfinity’s IBM is considered a “hybrid,” as shown in Figure 3, which minimizes risk and responsibilities for the business partner, making the Independent Broker Model accessible to significantly smaller teams than the above-mentioned 500 loans per annum.

Figure 3: Embedded finance Risk and Responsibility matrix

Companies adopting embedded finance via Realfinity’s model are anticipated to generate between 30-45 basis points (bps) in revenue. Having a deep understanding of their consumers, these companies are ideally positioned to cater to their mortgage needs. By utilizing existing consumer data—such as desired purchase range and area—these progressive businesses can enhance their consumers’ likelihood of securing loan approval via Realfinity’s fully digital platform, HomeDashboard.